Career Opportunities After PGDM in Finance

A PGDM in finance will set you up for many career opportunities. PGDM in finance is one of the most popular courses as students know the importance of finance in any industry. Finance makes the business world go round, and it is an industry that is highly regulated and protected by the government. Therefore, a career in this industry is a safe bet owing to its importance.

Professionals working in finance are also some of the highest-paid professionals. These are mostly expert positions that also come with a lot of perks and benefits. In the following blog, you are going to learn about these professions. After your PGDM in finance, you can decide which job suits you the most, so you can pursue it and have an excellent career.

Top 10 Jobs & Career Opportunities After PGDM in Finance

Though there are many jobs and career in the finance industry, the following are the best ones, representing different areas of expertise. If any of the following careers appeal to you, you can choose the right specialisations during your PGDM in finance to get the career you like. Here are the top 10 jobs & career opportunities after a PGDM in finance.

Financial Advisor

Financial advisors provide financial advice to their clients based on short-term and long-term finance. Financial advisors need to have a deep knowledge of the country’s various financial markets. They guide all their clients on the best markets to invest and grow their money. Financial advisors may provide their expert advice to individuals or even to investment companies.

Financial advisors are high in demand as people have realised is the best way for a comfortable living and early retirement is by investing in financial markets. Financial advisors may charge a percentage to their clients based on investment advice, or they may charge an annual, bi-annual, quarterly, or monthly fees. Many PGDM in finance graduates choose the financial advisor career owing to the high-earning potential in this profession.

Investment Banker

Investment bankers help companies raise funds through capital raising activities and mergers & acquisitions. They completely oversee these activities and are involved in all the processes. They need to have expert knowledge of all the capital raising activities. Investment bankers have to provide accurate valuation by using accurate business valuation models.

Investment bankers need to have excellent knowledge of the financial markets of the country. They also need to know the latest laws, including accounting and taxation laws, that affect the business in the country. Though they may choose to operate in a particular industry, investment bankers need to know about all the major industries of the country. Investment bankers get a large share or a sizable amount as fees.

Financial Planner

Financial planners plan all the financial management for their clients. They sit down with their clients, assess all their financial needs and goals, and make plans accordingly. The client then makes investments according to the financial planners' plans. They also provide financial advice from time to time, or as and when there are changes in the market.

Financial planners are well-versed in the financial markets and have to know all about the various financial instruments. Financial planners mostly provide advice and make plans, but sometimes, they are also required to make investments. Financial planners work in firms, but many of them, after gaining adequate experience, start their own business and work independently. This way, you can earn a lot of money.

Equity Analyst

Making use of various financial software and tools, equity analysts provide financial and investment advice to financial advisors, brokers, companies, and individuals. They have to know all the latest financial analysis software and tools that are being used. They have to develop financial models, input data and get the required results. This data has to be further processed into understandable visual representation to be converted into reports.

Equity analysts work individually, but financial firms can hire them and offer their analysis services. Equity analysts are in high demand as analytics software is becoming the next big thing in the world of business. With a PGDM in finance and knowledge in using analytics software and tools, you can make a good living.

Risk Assessor

The title of risk assessor clearly states their main job - to assess risk. Risk assessors assess the seen and unseen risks in all business transactions. They need to have a strong study of the prevailing market conditions, changes in rules & regulations, and other risk factors. Risk assessors conduct analytical studies, process data, and make predictions on the risk factors.

Risk assessors need to be tech-savvy and adept at using all the new risk assessment and analytics software to manage risks and make predictions. Risk assessors also have to make insurance strategies to protect the company’s business. In a volatile business world, a risk assessor is one of the most sought-after professionals. Companies can hire risk assessors as permanent employees or hire their services on a need basis.

Finance Manager

The finance manager is an expert position in a company. Finance managers are in charge of all the finances of the company. They manage the finance department and its employees. They have control of all the financial assets of the company and have to ensure everything is managed according to local and national laws. They also have to maintain books and reports according to the laws.

Finance managers need to have a deep understanding of the financial markets in which their company operates. They have to study, make predictions, and prepare plans for their company. In a growing company, a finance manager is one of the most important positions. Therefore, they get excellent salaries and benefits.

Financial Analyst

Making use of the latest finance analytics, financial analysts perform many tasks like collecting data, developing analytics models, making reports and presentations, and making predictions based on the reports. The senior management develops its financial plans based on these reports. Financial analysts need to have an excellent understanding of the financial markets and finance-related analytics.

In an increasingly technologically advanced world, financial analysts give companies a much-required edge, as their work is based on sound mathematical and scientific knowledge. Financial analysts are some of the most sought-after professionals and hence, they attract good salaries and benefits.

Portfolio Manager

Portfolio managers create and manage financial portfolios for their clients. Portfolio managers need to be experts in investment as they have to invest large sums of money on behalf of their clients. They need to be updated on the financial markets and also have to know all the latest laws, rules, and regulations regarding investment.

Portfolio managers also have to mitigate risks, for which they need to invest across a wide spectrum and ensure there is positive growth in the portfolios they manage. Portfolio managers also have other duties like giving financial advice, working with a research team, conducting their own research, and creating reports. Portfolio managers make an excellent living. Therefore, with a PGDM in finance, you can aim for this career.

Business Analyst

One of the most popular professions PGDM in finance graduates are choosing is a business analyst. This profession has gained a lot of importance since the increased use of business analytics. Business analysts have made a huge impact on the business world with their accurate analysis, which has led to the success of many companies. In simple terms, business analysts conduct a deep analysis of the business and provide suggestions on improvement.

Business analysts need to have a deep understanding of the business and industry their company operates in. After analysis, they make comprehensive reports on the business that mark out ways for improvement. They plan and monitor all business activities. They create unique financial models and also conduct variance analysis. A business analyst’s work is extremely important for the success of a business. Therefore, business analysts are some of the highest-paid professionals.

Credit Managers

Large companies operate on credit. They borrow a lot of money from the banks to scale up operations, enter new markets, expand into other countries, etc. The main job of the credit managers is to manage the borrowings of the company. Before the company undertakes any expansion operations that require credit, the credit managers are required to make strategies. They are also responsible for the repayment of the credit and keep the company’s books clean and profitable.

Credit managers have to know the market really well and should be able to assess the risks involved. They pay close attention to all the latest happenings in the market, new rules & regulations, and business opportunities. Given the current volatility of the financial markets, it's a good idea to pursue this career as its high in demand. Credit managers get paid well.

The finance industry and the careers in it are quite lucrative. Along with handsome pay packages, the above-mentioned professionals also enjoy many benefits. Job security and high growth opportunities are also additional factors that make these careers great. But the only way to these careers is a PGDM in finance. So, don’t wait anymore to enrol for this postgraduate course today!

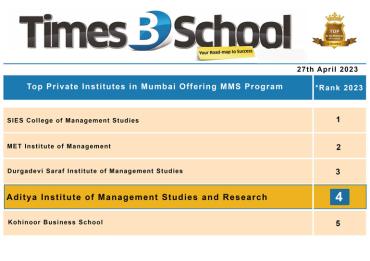

To get the most from your PDM in finance course, do it from Aditya Institute of Management Studies & Research. They are well-known for their PGDM courses that are AICTE approved and result in jobs in some of the companies in the country. Fill the form on the PGDM page to know more benefits of the PGDM in finance course.